Text: Nicole van ‘t Wout Hofland, Coretta Jongeling

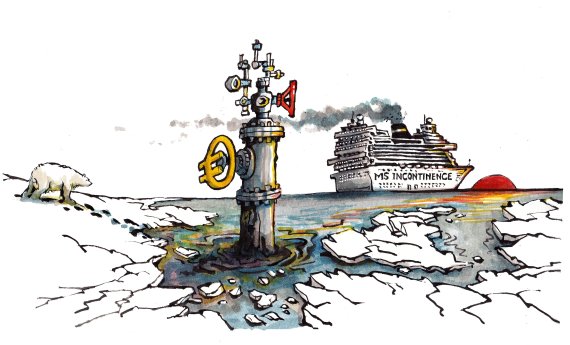

WUR researcher Jarno Gieteling was shocked to discover that ‘his’ pension fund ABP invests in oil drilling in the Arctic. He started a poll asking colleagues how they felt about having no influence on the portfolios in which their pension fund invests. Resource too has been getting people’s opinions.

WUR Student Challenges project coordinator

I want to invest my money well. That is why I deliberately chose a bank that focuses on sustainability. I also want to be able to determine what my pension money is invested in, but unfortunately we don’t have that choice at WUR. Pensions are about the future and a sustainable pension fund fits with that. But I don’t think ABP is sustainable. I used to be the coordinator of Green Office Wageningen, which works on improving sustainability at WUR. We tried to raise this issue with the university back then too, but to no avail. Of course the pension system is complex but I thought it was a shame that WUR was not prepared to discuss the issue.

PhD candidate in Molecular Biology

Given that WUR focuses on sustainability and the environment, I would have expected the university to have made a greener choice of pension fund. If I had a clear overview of all the pension funds and was allowed to make a personal choice, I would definitely choose a more environmentally aware option. On the other hand, it makes life easier if WUR has a fixed pension fund and I don’t have to choose. The fact that I don’t have to investigate the matter saves me time and energy.

PhD candidate at the Laboratory of Genetics

I think it’s wrong that we don’t have a say in the portfolios ABP invests in, whether it’s about oil drilling or other investments. I realize I’m not an economist, like most other people at WUR, so we can’t get involved in the financial side of the pension fund and its investments. Even so, we should have a say on where our money goes. Perhaps you get better returns on investments in oil drilling but if WUR wants to present itself as a pioneer in the field of sustainability, we should be prepared to accept lower returns.

Associate professor of Nematology

The WUR pension fund should not invest in oil drilling in the Arctic. Investing in sustainable projects gets you higher returns in the long run. We saw that during the financial crisis: Triodos Bank with its sustainable investments was one of the few to do well out of the crisis. Anyway, there is more to investing money than the financial aspect; personal convictions are just as important. That is why we employees should have more of a say in ABP’s investments.

Lecturer in Farming Systems Ecology

I think it’s unacceptable to be a beacon of innovation and sustainability and at the same time put our pension money into things that contradict our own future. That doesn’t make sense to me. Although I wouldn’t feel comfortable if the university was investing all of our money in things that were financially risky either. As far as I understand, the justification for investing in this portfolio is that fossil fuel investments are seen as stable. Of course it depends on what time frame you’re looking at. But I think that’s not a solid argument. So I would prefer for the university to think twice about what message we are sending about where our priorities are. We have to be creative in developing systems that would allow employees to say where they want their money going to. It’s our pay cheque for later. If that’s undermining our future on this planet, then we’re doing something wrong.

Lecturer in Strategic Communication My first reaction was no, I don’t want oil drilling. But I always try to look at something from multiple perspectives. The pension fund is collaborating with Shell and I understood that they are doing this precisely because they think it is important to be able to influence the sustainability policy of such a huge company. Pension funds are major investors, which means they have influence. The question is what result you get ultimately. Being able to choose your own pension fund sounds attractive but I wonder what the consequences would be. These funds are able to pay our pensions because they are so big. If you get a free choice, you lose out in terms of security and may undermine the entire pension system. I don’t think we can really know what the funds are doing: when the time comes to choose, they will highlight the good things and sweep the less attractive investments under the carpet. I think proper supervision and a clear framework are more important than the right to choose.

Illustration: Henk van Ruitenbeek

Illustration: Henk van Ruitenbeek